2020 Market Report Part 2

In part 2 of the 2020 Market Report we’ll dive deeper into the Macro Economic trends and start to show in detail what’s going on specifically in Southwest Florida. 2020 has been a whirlwind of a year, so Macro Economic trends are playing a HUGE role in the rapid changes and increases we’re seeing – so without understanding those as context, it’s impossible to understand the real estate market as a whole.

Inventory/New Construction: In Southwest Florida we’re dealing with record low inventories, and that’s in lockstep with trends nationwide. Fortunately, because of our many communities and development projects – we’re uniquely situated to deal with this issue, as many developers have been working for years to bring their projects to fruition. What does this mean? We are better positioned than other places to weather this storm of lack of inventory (from a labor and materials and planning perspective) so upward price pressure will continue to rise, but won’t be as dramatic as much of the rest of the country (buyers of new construction homes will continue to see large value opportunities to be had in new communities).

Inventory/New Construction: In Southwest Florida we’re dealing with record low inventories, and that’s in lockstep with trends nationwide. Fortunately, because of our many communities and development projects – we’re uniquely situated to deal with this issue, as many developers have been working for years to bring their projects to fruition. What does this mean? We are better positioned than other places to weather this storm of lack of inventory (from a labor and materials and planning perspective) so upward price pressure will continue to rise, but won’t be as dramatic as much of the rest of the country (buyers of new construction homes will continue to see large value opportunities to be had in new communities).

Home Values: National median home listing prices climbed 11% to $350,000 in September which also correlates to a 14% increase in the average price per square foot. The median home price (resale) for all housing types sold during September was $311,800 a 14.8% total increase when compared to a year ago and has peaked close to $329,000. As a result of such intense demand and vastly depleted inventory, list prices have continued upwards year over year every week since May, thereby accelerating this very “pro-sellers market“.

Amendment 5 & 6 Pass: In the 2008 ruling to the “Save Our Homes” benefit made one’s homestead exemption cap “portable“, allowing people to transfer their homestead from one property to another – keeping their property taxes low. Amendment 5, which just passed, extends the transfer period from two years to three years. Amendment 6 allows the transfer of a disabled veteran’s tax benefits to a surviving spouse who can then keep the tax break until they sell the property, remarry, or pass away.

Overall this is a huge win for the Florida property market, putting us in control of our dollars, and will keep our property taxes low for decades to come. In some states, like NY & NJ, taxes are the main cause for moving away – with even moderately priced homes fetching $20,000-$30,000 in annual property tax dues a truly outrageous ongoing burden to many homeowners.

Southwest Florida Real Estate Market

Pending Sales: So far we’re up 20% year over year and up a staggering 98% from this time last year. Although we have seen a slight dip recently as inventories dipped so low. In one area – Estero – for example, many homes I’m listing and buying are receiving 20+ offers because there is so much demand.

Pending Sales: So far we’re up 20% year over year and up a staggering 98% from this time last year. Although we have seen a slight dip recently as inventories dipped so low. In one area – Estero – for example, many homes I’m listing and buying are receiving 20+ offers because there is so much demand.

Closed Sales: Comparing this month to the same time last year we are up 71% in total closed transactions and up 139% in total closed volume. We’ve seen 3,785 close in the past 30 days, up 20% from the past 365 day 30 day average (3,043). The past year shows 36,525 sales which is up 8% when compared to all of 2019 closed sales (33,488) and a year that is now officially considered the top year of our longest increasing market in history.

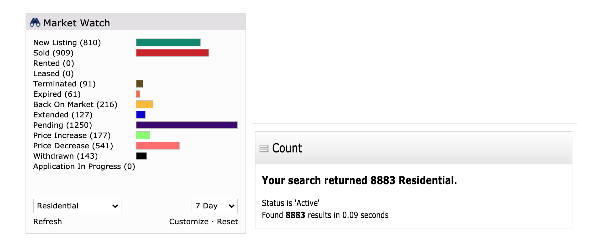

Inventory: In total, we only have 8,883 active listings. Based upon the 30 day “closed rate of absorption” we have 2.35 months of inventory and based upon the 30 day “pending rate of absorption” we have 2.12 months of inventory, 5 to 6 months is considered a balanced market. The inventory struggles are very real and we’ll start to see a direct correlation between pending/closed sales and the lack of supply.

Join The Discussion